“We are not a commercial real estate company that has technology. We are a technology company that

does commercial real estate. Our mission is to transform and improve the future real estate economy

through continuous innovation.”

Erik Gainor,

CEO

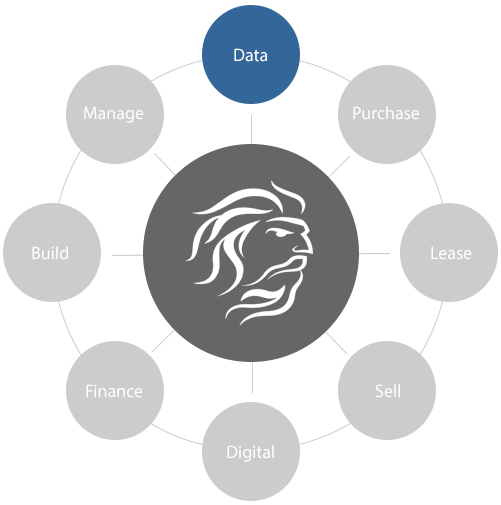

Zeustra is a leading global commercial real estate advisor providing scalable data-to-value solutions to property owners, investors, tenants, and financial institutions. We offer an unparalleled combination of deep fundamental research, predictive analytics, and transformative technologies that deliver superior performance. Our culture of continuous innovation and excellence is the driving force within our organization.

Our world class experts leverage data science and augmented intelligence to help clients maximize the value of every real estate decision. We offer a single source of truth (SSOT) and marketplace automation that delivers optimal outcomes when buying, selling, leasing, developing, and managing commercial real estate assets at scale.

Marketplace Automation, Dispositions, Valuations, Equity Placement, Due Diligence Support, Portfolio Planning

Growth Planning, Location Intelligence, Performance Forecasting, Predictive Analytics, Site Analysis

Landlord Representation, Tenant Representation, Cost Reduction, Location Analytics, Workplace Optimization, Design

Asset Management, Property Management, Lease Management, Tenant Services, Risk Management, Accounting Project Management, Building Information Modelling (BIM)

Acquisitions, Development, Refinancing, Loan Sales Advisory, JV & Structured Finance, Agency Lending, Small Balance Lending, Loan Servicing, CMBS

“We are not a commercial real estate company that has technology. We are a technology company that

does commercial real estate. Our mission is to transform and improve the future real estate economy

through continuous innovation.”

CEO

Centralized Data, Hyperscale Computing, Data Normalization, Data Aggregation, Real-Time Data, Omnichannel, Business Intelligence, Predictive AI

Marketplace Automation, Dispositions, Valuations, Equity Placement, Due Diligence Support, Portfolio Planning

Growth Planning, Location Intelligence, Performance Forecasting, Predictive Analytics, Site Analysis

Landlord Representation, Tenant Representation, Cost Reduction, Location Analytics, Workplace Optimization, Design

Site Selection, Acquisition, Disposition, Re-Entitlement, Master Planning, Construction

Acquisitions, Development, Refinancing, Loan Sales Advisory, JV & Structured Finance, Agency Lending, Small Balance Lending, Loan Servicing, CMBS

Asset Management, Property Management, Lease Management, Tenant Services, Risk Management, Accounting Project Management, Building Information Modelling (BIM)

Perfect Information, Machine Learning, Artificial Intelligence, Augmented Intelligence, Process Automation, Algorithmic Decision-Making

Leverage our data and artificial intelligence (AI) platform to make informed decisions that optimize the financial and operational performance of your real estate. Maximize value on acquisitions, sales, leasing, development, finance, and management all on a single source of truth (SSOT).

Explore our global database and use prediction models built by Zeustra to identify properties that maximize the ROI on every real estate acquisition. Let our experts guide you through a seamless due diligence process that delivers superior results.

We help landlords and tenants create inspiring workplaces designed for the future economy while reducing the impact on the bottom line. Improve financial performance with innovative 3D modeling technology that optimizes space utilization.

We offer the deepest and most current global buyer database, ensuring that every real estate sale closes at the highest possible price. Our disciplined due diligence and deep market intelligence delivers competitive advantages that outperform the market across all property types.

Transform your technology and data into scalable business processes and actionable intelligence that delivers predictable results in complex environments. Our agile solutions help real estate investors, landlords, and tenants respond quickly to change while maximizing the value of every real estate transaction.

We secure real estate financing on behalf of our clients through an unparalleled network of global lenders to help clients achieve their financial and operational goals. Secure financing for real estate acquisitions, development, and construction with flexible terms and at the most competitive rates.

Our seasoned real estate experts leverage innovative technology to carefully guide clients through the entire development cycle. Whether you are building a new facility or improving an existing one, our best-in-class development services team will walk you through every step of the site selection, design, and construction process.

Our property and asset management specialists leverage industry best practices and innovative technology designed to increase asset values while optimizing performance. Work with our management experts in real estate financial planning and reporting, accounting, and accounts payable to drive profitable growth. Track and report on activities while ensuring compliance all on one platform.

Highlights

Zeustra, LLC announced today its release of a proprietary data and artificial intelligence platform designed to futurize the commercial real estate marketplace. As a leading CRE advisor with over $10 billion in transactional volume, they see a rare opportunity to digitally transform an industry plagued by legacy data models and inefficient processes…

Amid volatile economic conditions resulting from the impacts of COVID-19, medical real estate remains a popular choice for investors as they search for stability and higher yielding opportunities in an economy with asymmetrical risk factors. According to the Office of the Actuary at CMS, national health spending growth will continue to outpace GDP growth through the year 2027, reaching $6 Trillion with an average annual rate of 5.5%.

We sat down with two tech pioneers at Zeustra to discuss the evolution of technology operations at the firm and across industries. CEO Erik Gainor and CTO John Wenger talk about how Zeustra helps clients automate processes and optimize real estate performance through digital transformation and continuous innovation.

Erik Gainor is the CEO of Zeustra. He oversees all aspects of Zeustra’s operations while leading the growth strategy and future vision of the company .

Highlights

Amid volatile economic conditions resulting from the impacts of COVID-19, medical real estate remains a popular choice for investors as they search for stability and higher yielding opportunities in an economy with asymmetrical risk factors. According to the Office of the Actuary at CMS, national health spending growth will continue to outpace GDP growth through the year 2027, reaching $6 Trillion with an average annual rate of 5.5%.

We sat down with two tech pioneers at Zeustra to discuss the evolution of technology operations at the firm and across industries. CEO Erik Gainor and CTO John Wenger talk about how Zeustra helps clients automate processes and optimize real estate performance through digital transformation and continuous innovation.

Erik Gainor is the CEO of Zeustra. He oversees all aspects of Zeustra’s operations while leading the growth strategy and future vision of the company.

Zeustra recently completed the sale of numerous medical properties across Texas, Florida, and Pennsylvania with a cumulative value of over $100 million. The sales included a cancer clinic, heart and vascular institute, urology clinic, advanced wound healing center, dermatology clinic, pain management, and an outpatient center. Jason Saunders, Corey Martier, and Nick Myers managed the sale of the facilities.

Corey Martier is Zeustra’s SVP of Sales for the Mid-Atlantic Region. He has completed over $1 Billion in medical real estate transactions on behalf of private practices, hospitals, developers, and institutional investors.

Q: So what makes working for Zeustra different from other real estate firms?

I think the biggest differentiator is Zeustra’s relentless commitment to technological innovation designed to maximize the profitability of its agents […]

Zeustra continues its buying spree on new technology with strategic partnerships offering significant advancements in building information modelling (BIM), location intelligence, big data, API connectivity, process automation, and artificial intelligence. All of these investments further Zeustra’s vision of becoming a single source of truth (SSOT) for the commercial real estate industry.

Corey Martier is Zeustra’s SVP of Sales for the Mid-Atlantic Region. He has completed over $1 Billion in medical real estate transactions on behalf of private practices, hospitals, developers, and institutional investors.

Q: So what makes working for Zeustra different from other real estate firms?

I think the biggest differentiator is Zeustra’s relentless commitment to technological innovation designed to maximize the profitability of its agents […]